Tom Quaadman

Tom Quaadman

Former Senior Vice President Economic Policy, U.S. Chamber of Commerce

Published

September 16, 2021

Key Takeaways:

- The U.S. has one of the highest capital gains tax rates in the world and new research conducted by EY shows that the Biden Administration’s proposal to raise the capital gains tax rate to 49.3% will clearly establish the U.S. as having the highest rate, putting the U.S. and American business at a competitive disadvantage.

- While proponents of capital gains tax rate increases contend that only a few Americans will pay the higher taxes, in actuality millions of Americans and businesses will pay the price, including workers, consumers, and retirees.

- Raising the capital gains rate is an incredibly misguided policy recommendation. Rather, policymakers should be doing everything in their power to help the U.S. economy recover from the pandemic so that businesses can grow, compete, and innovate.

As Congress considers tax increases, we need to take into account the competitiveness of the U.S. economy in a global economy. China’s positioning of Shanghai as an international destination for capital is one more sign of this stiff international competition. These tax debates matter because they change incentives. Raising taxes on investors and businesses will make it less attractive to invest in the U.S., which will end up hurting American workers, consumers, and retirees.

Through the process known as “Budget Reconciliation,” which circumvents the normal legislative process, the Biden Administration and certain Democrats in Congress have set their sights on raising tax rates on corporations and individuals. One of the many provisions that are particularly concerning, in a bill that is filled with threats to both our recovery from the pandemic and long-term prosperity, would increase the capital gains tax rate.

Capital gains represent the rewards for placing investment capital at risk and are a critical element as businesses seek to form and expand operations. All investors – businesses and individuals – are subject to taxes on their capital gains. While proponents of capital gains tax rate increases contend that only a few Americans will pay the higher taxes, in actuality millions of Americans and businesses will pay the price of the proposed tax increases. Existing rates on capital gains already put the U.S. at a global disadvantage: the only reasonable discussion for rate changes would be about making our markets more competitive, not less.

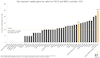

Comparing existing U.S. capital gains rates and those proposed by President Biden to Organization for Economic Cooperation and Development (OECD) and BRIC (Brazil, Russia, India, and China) countries paints a highly unflattering picture of U.S. global competitiveness. According to research conducted by Ernst & Young, the top U.S. capital gains rate in 2021 stands at a combined rate (including the net investment income tax and average state individual income tax rate) of 29.7%, well above the OECD / BRIC weighted average of 20.2%. Under the Biden Administration’s tax proposal, the top U.S. capital gains rate would soar to 49.3%, the worst among 42 OECD and BRIC countries and more than twice the OECD / BRIC average.

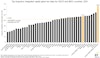

And yet our global competitiveness is even worse when we also account for the double taxation of corporate income, first occurring at the corporate level and then at the shareholder level. Combining the top federal and state corporate income tax rates into capital gains, referred to as the top integrated capital gains rate provides a more accurate assessment of capital gains. In 2021 and under current law, the U.S. top integrated capital gains rate is 47.8%, well above the OECD / BRIC average of 41.8%. Concerningly, under the Biden Administration’s tax proposal, the top U.S. integrated capital gains rate would soar to a staggering 65.9%.

Whether one considers the Biden Administration proposals or the proposals made under the current budget reconciliation process, the U.S. capital gains rate would be the worst among OECD and BRIC countries, or just shy of that unenviable crown. Economic models and history all reach the same conclusion: significantly increasing taxes on capital gains result in significantly less capital investment, harming American growth, competition, and innovation.

Raising the capital gains rate is an incredibly misguided policy recommendation. While supporters in Congress may see an increase in the capital gains rate as only a number on a spreadsheet to raise revenue for an economically devastating budget reconciliation bill, we see entrepreneurs and businesses who will be disincentivized from opening new or expanding upon existing businesses, and workers who will lose out on jobs that could have been created by enterprising U.S. innovators.

Policymakers should be doing everything in their power to help the U.S. economy recover from the pandemic and to further encourage businesses to grow, compete, and innovate. We ask them, why would you choose to deliberately harm U.S. economic competitiveness and job creation?

About the author

Tom Quaadman

Thomas Quaadman is former executive vice president of the U.S. Chamber Center for Capital Markets Competitiveness (CCMC), the Chamber Technology Engagement Center (C_TEC), and the Global Innovation Policy Center (GIPC).