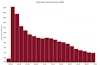

The November jobs report paints a contradictory view of the labor market. The topline figure of 210,000 jobs added during the month fell far short of consensus estimates of 550,000 jobs. Even worse, the November tally is also far fewer jobs than the economy created in October (+546,000) and September (+379,000).

But, as disappointing as the topline figure is, other data points to some positive signs related to job growth and the ongoing workforce shortage. For instance, more than 1.1 million more people were employed in November than in October according to Bureau of Labor Statistics (BLS) data on individual work status.

Even better, almost 600,000 people entered the workforce in November. This data not only puts the November jobs report in a different light, but with almost 3 million more job openings than unemployed workers, the influx of workers into the labor market also gives business leaders reason for optimism.

To be sure, the BLS has been revising initial estimates of monthly job growth upwards significantly over the last few months. Part of the reason is because surveying businesses has been particularly difficult for BLS during the pandemic. It is entirely possible that the November jobs estimate could be revised upwards by a large margin.

Even if it is, however, there is still a wide gap between open jobs and workers available and willing to fill them. There are almost 2.4 million fewer workers in the labor market than there were in February of 2020, and getting those people back to work is critical to reduce the number of job openings.

Despite 600,000 more people entering the workforce last month, the labor participation rate still lags pre-pandemic levels. The current labor force participation rate is 1.5 percentage points below pre-pandemic levels — if we had the same participation rate as in February 2020, there would be 4.4 million more workers in the labor force.

The fact that there is such a wide disparity between the two figures is what makes the November jobs report so confusing,

The business side of the survey is one most analysts use because it is less volatile than the individual survey. But when they tell such different stories it is important to dig a little deeper. With all other signals showing job growth was stronger in November than the business survey showed, and the recent trend of large revisions, it is likely the individual report is a more accurate portrayal of what is going on in the job market right now. At the very least it is reason not to overreact to the disappointing headline job growth figure.

Beyond those figures, here are some other useful data points in the November jobs report:

- Professional and business services added 90,000, the most of any industry in November. Transportation and warehousing added 50,000, while Leisure and hospitality added 23,000 jobs in the month. Government shed 25,000 jobs, and retail lost more than 20,000 jobs.

- Wages rose 0.26% from October and 4.8% annually. Inflation is higher than this on a monthly and annual basis, which means real wages are declining.

- There remain 3.9 million fewer Americans employed than in February 2020.

- At the November pace, it would take 19 more months to get back to pre-pandemic employment levels. That would be faster than the Great Recession, at around 3.5 years. It took 6 years, from January 2008 to July 2014, for the labor market to recover from financial crisis.

About the author

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.