Neil Bradley

Neil Bradley

Executive Vice President, Chief Policy Officer, and Head of Strategic Advocacy, U.S. Chamber of Commerce

Published

March 06, 2024

With the inflation debate and what the Administration proposes to do about it taking center stage at this year’s State of the Union, the U.S. Chamber compiled recent examples of when the Administration wrongly blamed business for high prices. At the same time, many of the White House’s proposed solutions would actually raise prices for most consumers.

On January 10, 2022, TheWashington Post ran a story that contained some startling on-the-record admissions. For several months, Democratic pollsters had been warning the Biden Administration that they needed to provide a “villain” to blame for high prices:

“What we said is, ‘You need a villain or an explanation for this. If you don’t provide one, voters will fill one in. The right is providing an explanation, which is that you’re spending too much,’” one Democratic pollster who, like the others, spoke on the condition of anonymity to reflect private conversations, told The Washington Post. “That point finally became convincing to people in the White House.”

And thus began the effort to wrongly blame employers for high prices.

As the same story noted, there was just one problem: experts inside the administration, and even some at left-leaning organizations, didn’t believe that the facts supported the accusations.

"Senior officials at the Treasury Department, for instance, have been unsettled by the White House’s attempts to blame some large corporations for inflation, skeptical of that explanation for the recent rise in prices, according to four people with knowledge of internal administration dynamics," The Washington Post mentioned.

“I don’t think corporate consolidation explains the jump in prices,” said Dean Baker, a liberal economist who endorsed Warren’s presidential candidacy in 2020. Baker said he had relayed this skepticism to the White House. “I don’t see a good story here in blaming inflation on concentration.”

Claudia Sahm, a liberal economist who worked at the Federal Reserve, added, “I don’t understand the strategy. It must have something to do with politics, but you’re not going to get many economists to back up the argument that it’s going to address inflation right now.”

It should, therefore, be no surprise that when the President and the Administration started blaming companies for specific price hikes, the facts didn’t support the assertions.

1. President Biden Wrongly Blames High Price on Cargo Companies

June 2022: President Biden speaks at the port of Los Angeles and blames higher cargo shipping costs on container companies, suggesting that the companies had formed groups to raise prices by as much as 1,000 percent.

Reality: The increased prices were a result of consumers shifting their spending from services to goods during the pandemic—increasing cargo demand and leading to higher prices. At the same time, the increased demand created backlogs at the ports, raising prices even higher. As supply and demand normalized, prices fell. Prices continue to adjust as external events, like the security difficulties in traversing the Red Sea, impact shipping routes and supply and demand.

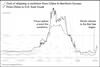

This chart from the New York Times, helps illustrate what has happened:

2. White House Wrongly Tries to Blame Meat Prices on Industry Concentration

December 2021: The White House National Economic Council attempts to blame high meat prices on “dominant corporations in uncompetitive markets taking advantage of their market power.”

Reality: As the Chamber explained at the time, market concentration in the meat packing industry has been virtually unchanged for 25 years. This raises the obvious question: if high prices are the result of corporate greed, why did these “greedy” companies wait two decades to raise prices? In reality, changes in meat prices have been driven by supply and demand changes during the pandemic and by overall inflation.

3. The President Incorrectly Blames High Gas Prices on Oil Company Profits

October 2022: Ahead of the midterm elections, President Biden publicly blamed high gas prices on oil company profits.

Reality: As the President himself partially acknowledged, gas prices are determined by the global price of oil, which in turn is determined by supply and demand. Events like Russia’s invasion of Ukraine can cause expected supply to fall and prices to rise. Similarly, a fall in demand due to a pandemic or an economic downturn causes prices to fall. When prices fall, oil companies make less money. When prices rise because of a reduction in supply or an increase in demand, their profits rise.

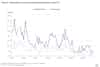

The government’s own data clearly show how price changes are a reflection of the changes in supply and demand.

4. White House Wrongly Blames Food Prices on Grocery Store Profits

February 2024: In June of 2023, the White House Council of Economic Advisors touted the signs of cooling grocery inflation. White House staff correctly acknowledged, however, that prices would remain elevated because of the various “sources of grocery price pressure, including a robust labor market that is supporting higher wages for workers along the food supply chain.” Seven months later, the White House decided that rather than explaining the real source of higher prices, they would blame the profits of grocers.

Reality: The President’s economists were right the first time: higher grocery prices are a result of inflationary pressure across the supply chain and basic supply and demand dynamics. This has been explained by economists at the Department of Agriculture and the non-partisan Government Accountability Office.

5. The President Wrongly Blames Companies for 'Shrinkflation'

February 2024: President Biden used the release of his first TikTok video to blame businesses for “shrinkflation,” singling out various products with the allegation that this was another way companies were raising prices on consumers.

Reality: Companies routinely change the size and price of products for a variety of reasons, including to reflect consumer demand and preferred price points and to optimize packaging. The government tracks the size of thousands of goods. As the government’s own chart illustrates, sometimes the size of the product gets bigger, and sometimes it gets smaller. In recent years, the number of packages that have downsized has actually fallen. This is all part of normal market fluctuations.

Five Ways the White House 'Price Control' Agenda Actually Raises Prices

As evidenced above, businesses do not cause the reduction in supply, the increase in demand, or the growth of the money supply. Businesses do, however, naturally react to changes in market prices that result from those factors. Placing the blame for inflation on the shoulders of businesses is, therefore, turning the causality of this economic phenomenon entirely backward.

The truth is the Administration’s own fiscal and regulatory policies are driving inflation, and the American consumer is left holding the bag.

1. Administration Investigates Companies for Offering Discounts

Given the Administration’s desire to help lower prices, it is bewildering that the Federal Trade Commission (FTC) is attempting to resurrect the eighty-year-old Robinson-Patman Act that hasn't been enforced in over forty years to prohibit companies from offering discounts.

The FTC’s investigations appear to be premised on the idea that when a business offers different prices to different customers (e.g. because they buy in bulk or they buy early), the business is engaging in illegal price discrimination. Administrations of both parties stopped enforcing the Robinson-Patman Act because they wanted to encourage, not prohibit, companies from offering discounts.

The FTC has launched investigations into the alcohol and soda industry and is threatening a wholesale revival of the Robinson-Patman Act. If implemented, consumers would see the end of discounts on travel when they book early, savings when they shop at large or bulk retailers, and potentially an end to most other discounts.

2. Raising the Price to Buy a Car

Technology and competition have made it easier than ever to compare prices and shop for a new vehicle. That hasn’t stopped the Federal Trade Commission (FTC) from deciding that they want to regulate the process. Last year, the FTC issued the “Combating Auto Retail Scams Trade Regulation” (CARS) Rule. The FTC claims that the new regulations will save consumers time and money. But like most government regulations, the real result is higher costs for consumers.

Under the rule, dealers would be required to provide purchasers with voluminous new information about pricing and options, almost all of which is already readily available online. The FTC assumed—without study—that that rule would save consumers time and money, but an actual study found the opposite: the rule could cost consumers $38 billion over ten years, impose $51,000 in annual costs on dealers, and force both dealers and purchasers to spend hours more time filling out paperwork. These costs will ultimately be borne by car buyers.

3. Higher Costs for Most Credit Card Users

When consumers pay bills late, it is expected that they will incur a late fee. These fees help cover the costs incurred by businesses from late payments. The Consumer Financial Protection Bureau (CFPB) has decided that late fees on credit cards are too high and has issued a regulation to cap the fees.

While this might be welcome news to those who routinely pay their credit card late, for the vast majority of Americans who pay on time, the result will be higher costs as companies are forced to shift the expenses caused by late payers onto responsible buyers. The CFPB even admits that this will be the outcome stating:

“Cardholders who never pay late will not benefit from the reduction in late fees and could pay more for their account if maintenance fees in their market segment rise in response - or if interest rates increase in response and these on-time cardholders carry a balance.”

4. An End to Free/Low-Cost Checking

The financial well-being of millions of Americans has been improved over the last several decades by the growing availability of free/low-cost checking services. Of course, it still costs banks to provide these services; it is just that they are able to offset those costs with fees on other services, including when a customer overdraws from their account. The Consumer Financial Protection Bureau (CFPB) wants to impose new regulations that limit these fees. This will likely force banks to eliminate overdraft options and other banking services altogether. The result will be higher costs for most banking customers.

5. More Confusion and Higher Prices for Airplane Tickets

In recent years, airlines have been able to offer consumers various options for lower-priced fares. By charging specific fees for those passengers who wish to check a bag or who are willing to pay for premium seating, airlines are able to lower the base price of a standard fare. If you are confident your plans won’t change, you can often get a lower price than if you wish to have a refundable ticket.

The Department of Transportation has proposed a new rule that would require these and other fees to be included in the initial price for a ticket provided on websites and elsewhere. Not only will this approach create more confusion about the actual base price of an airline ticket, but it may also lead to higher overall prices as it becomes more difficult for passengers to locate and book the lowest possible fare. Further, as a columnist for The Washington Post recently explained, this effort to limit airlines' ability to charge fees for specific services will only result in prices being higher overall for the passengers who are not interested in those services. Why, for example, should you have to pay for Wi-Fi on a plane if you don’t intend to use it?

About the author

Neil Bradley

Neil Bradley is executive vice president, chief policy officer, and head of strategic advocacy at the U.S. Chamber of Commerce. He has spent two decades working directly with congressional committee chairpersons and other high-ranking policymakers to achieve solutions.