J.D. Foster

J.D. Foster

Former Senior Vice President, Economic Policy Division, and Former Chief Economist

Published

May 04, 2018

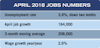

Today’s jobs report from the Bureau of Labor Statistics reveals ongoing and widespread strength in labor markets. The decline in the unemployment rate was surprising and is likely attributable to transitory statistical issues rather than a surge in employment.

America’s economy has found the sweet spot, and it’s been a long time coming. At 3.9%, unemployment is exceptionally low. How low is it? In contrast, the Congressional Budget Office’s estimate of long-run, stable unemployment is 4.8%.

Tight labor markets are increasingly compelling American businesses to raise wages much faster than in the recent past just to keep the workers they already have. While wage acceleration may alter some business plans, this is great news for American families and for the economic expansion overall. It means the gains from the expansion are spreading more widely, creating a stronger base for future growth.

Even with strong job growth and low unemployment, inflation remains subdued and below the Federal Reserve’s target of 2%. Though interest rates have crept up lately, low and well-anchored inflation expectations are contributing to a still very low interest rate environment. When added to the ongoing benefits of regulatory relief and tax reform’s continued benefits, the U.S. economy’s future looks remarkably bright.

It’s important to appreciate fully this good news because being in the economic sweet spot like this is very rare, and it’s been a long time coming. Why did it take so long? While many individual policies contributed, the overarching explanation was a relatively downcast psychology that permeated much of the U.S. economy and was directly attributable to President Obama’s slow-growth economic policies.

While stock market analysts often reference a market’s psychology, the concept is rarely invoked when talking about the economy. Economists like data, formulas, and concrete concepts. It’s hard to factor a national state of mind into an economic model, but that inability doesn’t make the concept any less important.

Unlike most economic factors, psychology can shift on a dime. A subdued psychology across the economy prevailed during the Obama administration’s latter years and a much more positive psychology took hold almost immediately after President Trump’s election. The stock market’s response – not to mention the almost immediate pickup in economic growth as measured by GDP – render such an observation indisputable.

The Trump administration’s regulatory reforms, which removed substantial burdens and uncertainty for American businesses, followed by a powerfully pro-growth tax reform have each given the economy substantial additional impetus. For decades, American businesses struggled to compete under the weight of the old tax system. The new system featuring much lower business tax rates, expensing, and a competitive international tax system makes American businesses much stronger competitors and suggests much stronger economic growth in the years to come.

Widespread optimism is also apparent in the traditional measures of consumer and business sentiment. For example, the University of Michigan’s index of consumer sentiment is up 7 points, to 97.8%, since 2016. All three of the new sentiment indices from the U.S. Chamber are showing similarly strong readings:

- The MetLife & U.S. Chamber Small Business Index indicated 66.3% of small businesses have a positive outlook about their company and the small business environment, up almost 3 points from a year ago.

- The RSM Middle Market Business Index, produced in partnership with the U.S. Chamber, achieved a composite score of 136.7 in Q1 of 2018, up over 4 points compared to the same period in 2017.

- TheUSG + U.S. Chamber Commercial Construction Index, reporting a score of 74 in Q1 of 2018 evidences a healthy commercial construction industry.

The issue of psychology also comes into play for the economy going forward, but not always positively. President Trump has launched a dramatic series of deeply unsettling trade policy shifts involving tariffs and additional measures as our trading partners respond in kind. Whatever the final outcome of these actions, they create an unwelcome, new economic headwind.

To be clear, the headwind is not itself yet a hurricane. However, the anti-growth nature of these trade policies, and the uncertainties they create about where trade policy is going and the final outcome may deeply wound the positive psychology now dominant. It wasn’t the Obama administration’s policies individually that produced a subdued psychology, but rather the policies collectively and the message this sent about the Obama administration’s attitude toward economic growth. With its new trade policies, the Trump Administration risks inflicting similar damage on economic psychology and thus on future growth. Having hit the sweet spot, we need to do everything we can to stay on course.

About the author

J.D. Foster

Dr. J.D. Foster is the former senior vice president, Economic Policy Division, and former chief economist at the U.S. Chamber of Commerce. He explores and explains developments in the U.S. and global economies.