Key Takeaways

- There are 33.2 million small businesses in America, which combined account for 99.9% of all U.S. businesses.

- Small businesses are credited with just under two-thirds (63%) of the new jobs created from 1995 to 2021.

- In 2021, a record breaking 5.4 million new business applications were filed in the U.S.

In terms of their impact on the economy, small businesses aren’t actually that small.

Small businesses are generally defined by the U.S. Small Business Association (SBA) as independent businesses having fewer than 500 employees. Based on SBA's definition, there are 33.2 million small businesses in America, which account for 99.9% of all U.S. firms.

Small businesses are credited with just under two-thirds (63%) of the new jobs created from 1995 to 2021, or 17.3 million new jobs. Small businesses represent 97.3% of all exporters and 32.6% of known export value ($413.3 billion). They also employ almost half (46%) of America's private sector workforce and represent 43.5% of gross domestic product.

By almost any measure, small businesses are a vital part of the American economy and workforce.

Apply for the CO—100

Applications are open now for the CO—100, a premier awards program honoring top small businesses across the country. Honorees will receive exclusive opportunities, brand exposure, and networking.

Small Business Starts to Reach New Highs

Entrepreneurship is booming in the U.S. In 2021 alone, a record-breaking 5.4 million new business applications were filed, and nearly as many (5.1 million) were filed in 2022.

New economic needs and changing consumer preferences during the COVID-19 pandemic created more circumstances for new businesses to start. Many individuals turned their ideas and hobbies into businesses that could be run from home, and the number of e-commerce retailers skyrocketed. Professional and business services were not far behind, as entrepreneurs tapped into the need for personal consulting services.

The U.S. Chamber has set up an interactive map to track the increase in new business applications by state.

Honoring America's Top Small Businesses

Inflation Bites

Amid historically high inflation, many small businesses are struggling to keep up with rising prices. Over the past year, inflation has been the top concern of small businesses by far, according to the MetLife and U.S. Chamber of Commerce Small Business Index. In the latest survey, over half of small businesses said inflation is the top challenge facing the small business community.

Access to Capital Declines

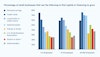

Over the long term, small businesses’ perceived access to capital to fund and grow their business has declined.

According to the Q1 2023 Small Business Index, almost half (49%) of small business owners said their current access to capital or loans is good. This is slightly lower than those who rated their access to capital as good in Q2 2022 (54%) and significantly lower than in Q2 2017 (67%).

Small Business Owners Are Working Harder

Small business owners report working longer hours than they used to just a few years ago.

Six years ago, 30% of small businesses said they were working more hours than they were a year ago. In 2022, half (50%) of small business owners said they are working more hours now than they were a year ago. This equates to a very significant 20-percentage point increase in the share of small business owners who report working more hours.

One factor that might be contributing to owners working longer hours is the persistent worker shortage. Right now, we have more than 10.8 million open jobs in the U.S., but only 5.9 million unemployed workers. In other words, if every unemployed person in the country found a job, we would still have almost 5 million open jobs. The lack of workers is hitting small businesses across almost every industry: Recently, the National Federation of Independent Business (NFIB) found that almost half (47%) of small business owners reported job openings that were hard to fill.

Strengthening Local Communities

Consumers are increasingly looking to support businesses in their local communities. Small Business Saturday has become a great way to support small business owners in neighborhoods across the country every year around the holidays—but there are many reasons to support local businesses year-round.

At the same time, small businesses are looking to reciprocate goodwill and give back to their local communities. When asked about how they have engaged with their community in the past year, here are small businesses’ most popular answers:

- 70% have encouraged employees to shop at local small businesses.

- 66% have donated to local charities over the past year.

- 64% say they sponsored or donated goods/services to local events.

- 56% say they offered discounts to certain groups within the community, like teachers or veterans.

To keep up with the U.S. Chamber’s latest small business content, visit the Small Business page.

Empower Your Small Business

Join the U.S. Chamber of Commerce and gain access to exclusive resources, expert insights, and a powerful network dedicated to helping your business thrive. Together, we’ll tackle challenges, drive growth, and amplify your voice in Washington and beyond.